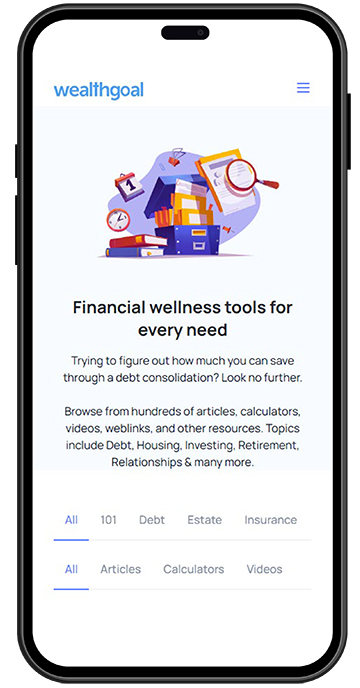

Offer your employees peace of mind with 24/7 access to online financial wellness. Your employees have the luxury of learning at their own pace, using a program that is customizable to suit their own unique learning style and level of financial knowledge.

Wealthscore – a personalized score indicating overall financial wellness with a customized action plan explaining where to improve.

Explore customized learning

plans suited to their personal

situation and learning style

Identify how to address common

life events like saving for retirement,

losing a job, caring for an aging

relative, buying a home, and more

Watch financial planning videos

Complete a holistic financial health

assessment & receive a customized

action plan

Learn how to reduce their debt,

create a budget that works, and

ensure their retirement is on track

Ask an expert their financial

planning questions

Use financial modeling

tools, read articles, and find

important financial information

Request a demo today.

GOFinancial planning can be daunting. Empower your employees to make informed financial decisions with the help of our financial education and literacy seminars.

This program is for those aged 25-35 focuses on topic relevant to what Forbes reports as the age group under the most financial stress.

This ½-day program includes:

This program is for those aged 35-50 offers useful plans for saving and budgeting for a demographic whose number one reason to delay retirement is not having enough money in savings.

This 1-day program include:

This program is for those aged 50+ provides useful information for employees who are or would like to be on their way to retirement.

This 1-day or 2-day program includes:

My Finances

Financial Planning 101

Money Management

Debt Reduction

Budgeting

Investing

Retirement Planning

Wills

Estate Planning

Identity Theft

We have over 25 topics to choose from. View our seminar catalog or speak with a Financial Education Specialist today.

Please enter your access code to view the seminar catalog

Don’t have an access code?

Enter your email address below and we’ll get one to you.

Your employees deserve honest, unbiased financial planning and education,

not a sales pitch. Because Acquaint does not sell financial products, you can

be confident that your employees will receive high quality, objective help,

personalized for their financial needs.

Sometimes only a personal touch will do. Our one-on-one financial

planning and counseling services can help employees when they need to

make informed lifelong financial decisions. Some situations include early

retirement windows, layoffs & downsizing, selecting group retirement plan

options, short-term or long-term disability, addictions leading to financial

distress, and more.

Our 1-on-1 financial planning services can be delivered on an hourly basis

or by mandate. The service is offered both on and off-site.

Our 1-on-1 financial planning is an hourly service that is completely customizable.

GO

Financial emergencies and concerns often arise unexpectedly and at the least

convenient times. Thankfully, confidential and reliable help for your employees

is just a phone call away.

Our Financial Hotline is available when your employees need help the most,

providing timely professional assistance from our knowledgeable staff before

financial concerns can become financial disasters.

Often, an employee is embarrassed to seek assistance about their personal financial

circumstances at work because they feel that it might negatively reflect upon their

standingwith their employer. Times of personal financial crisis may lead to low levels

of productivity and the use of valuable company time by your employees as they

search for solutions to their problems.

TIME reports that one-on-one financial education is the most effective method to bolster employees' confidence and financial knowledge, which often leads to greater contributions to retirement plans.

Learn how financial hotline service can help your employees in a personal & confidential manner over the phone.

GO